Royal Vopak, a leading global provider of storage and terminal services, has reported impressive financial results for Q3 2023. The company achieved an EBITDA of EUR 241 million and has increased its FY 2023 EBITDA outlook to around EUR 970 million. This growth is a testament to Royal Vopak’s strong market demand and commitment to improving financial and sustainability performance.

In addition to its financial success, Royal Vopak has reached an agreement on the sale of its chemical terminals in Rotterdam, the Netherlands. This strategic move will streamline the company’s portfolio and allow it to focus on its core growth and acceleration initiatives.

Royal Vopak is actively pursuing growth opportunities. The company has commenced construction on the fourth LNG tank at the port of Rotterdam, solidifying its position as a leader in the industry. Furthermore, Royal Vopak is expanding its industrial terminal presence in Singapore with additional pipeline connections, enhancing its capabilities and providing better services to its customers.

In line with its commitment to sustainability, Royal Vopak is collaborating on the development of a large-scale, low-carbon ammonia production and export project on the Houston Ship Channel. This project highlights the company’s dedication to new energies and sustainable feedstocks. Additionally, Royal Vopak has commissioned repurposed infrastructure in the port of Los Angeles, United States, specifically designed for storing low-carbon fuels.

Dick Richelle, the CEO of Royal Vopak, expressed his satisfaction with the strong demand for the company’s services, as reflected in the improved proportional occupancy rate of 92 percent. Richelle emphasised the company’s focus on long-term value creation through disciplined and balanced capital allocation. He also highlighted Royal Vopak’s well-diversified portfolio and streamlined organisational structure, which position the company well to execute its growth strategy effectively.

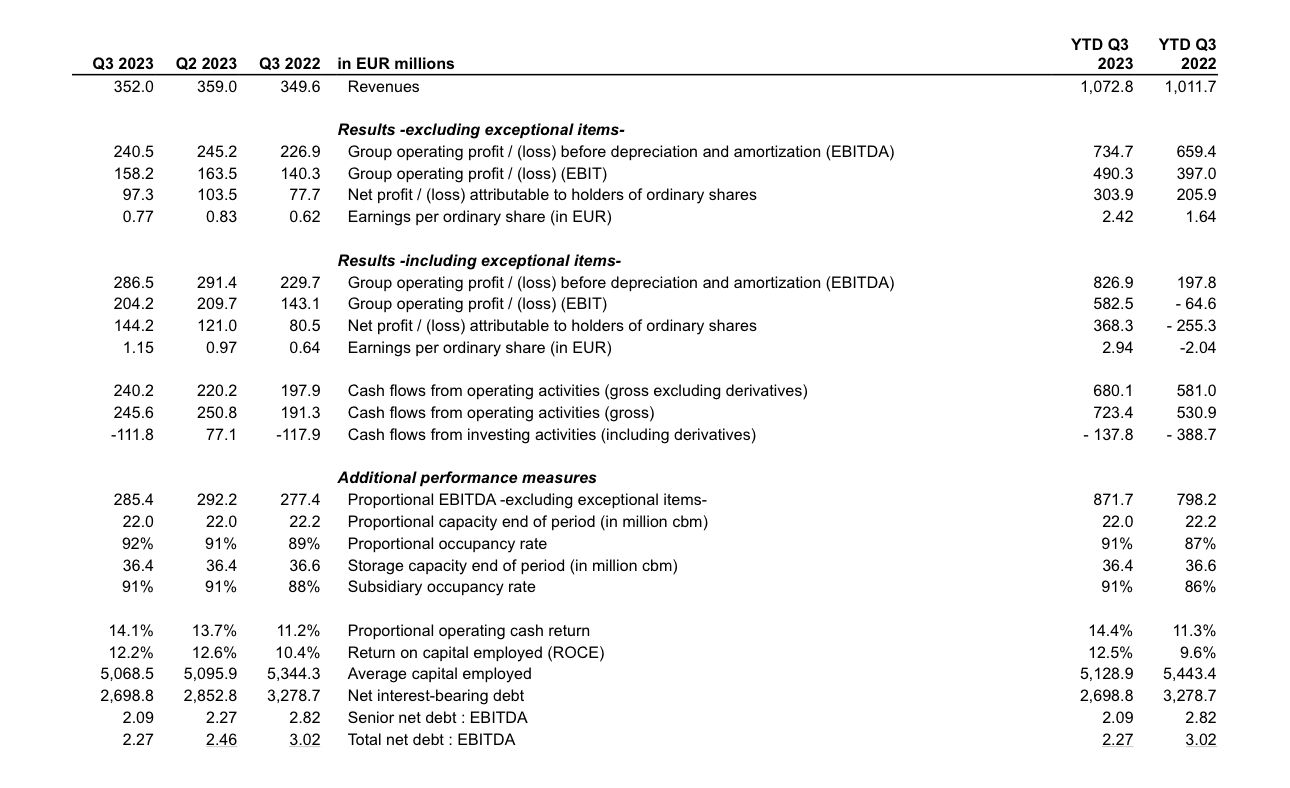

Financially, Royal Vopak reported increased revenue of EUR 1,073 million, despite divestment impact and unfavorable currency translation effects. The company’s EBITDA increased by 12 percent compared to the previous year, driven by organic growth. With a net debt to EBITDA ratio of 2.27x, Royal Vopak remains below its target range of around 2.5-3.0x.

Royal Vopak’s impressive performance and strategic initiatives demonstrate its commitment to delivering exceptional services, driving sustainable growth, and contributing to a greener future in the storage and terminal industry.

For more information visit www.vopak.com